Accounting ERP sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As we delve into the world of ERP systems in accounting, we uncover the seamless integration that revolutionizes financial processes, paving the way for enhanced efficiency and decision-making.

In the following sections, we will explore the key features, implementation steps, benefits, and comparison of accounting ERP systems, providing a comprehensive guide for businesses seeking to optimize their financial operations.

Introduction to Accounting ERP

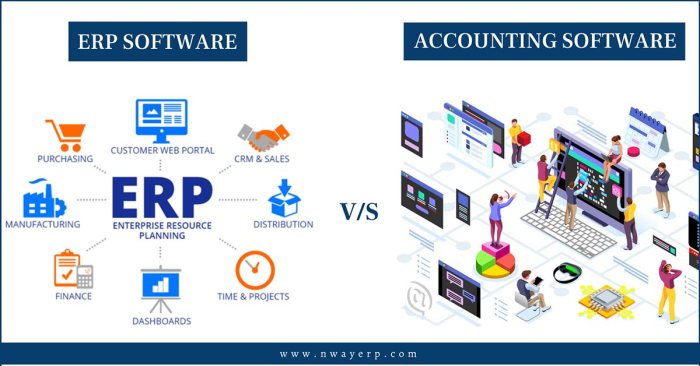

Accounting ERP (Enterprise Resource Planning) refers to software systems that integrate various financial and accounting processes within an organization. These systems are designed to streamline and automate tasks related to financial management, reporting, and analysis.

Streamlining Financial Processes

ERP systems play a crucial role in streamlining financial processes by centralizing data and eliminating the need for manual data entry. By automating tasks such as accounts payable, accounts receivable, and payroll, organizations can achieve greater efficiency and accuracy in their financial operations.

Importance of Integrating Accounting with ERP Systems

Integrating accounting with ERP systems is essential for ensuring data consistency and accuracy across all departments. By connecting accounting functions with other business processes such as inventory management and customer relationship management, organizations can gain a holistic view of their operations and make more informed decisions.

Features of Accounting ERP

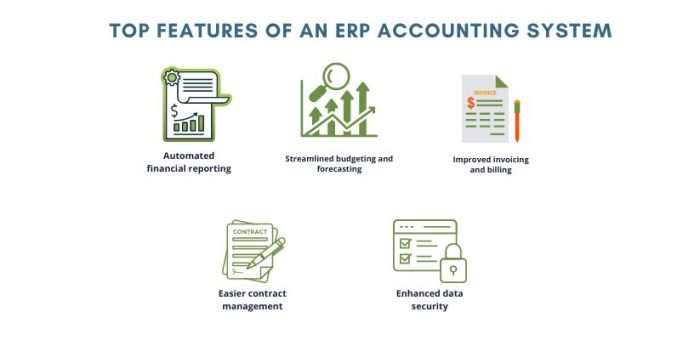

Accounting ERP software offers a wide range of features that help businesses streamline their financial processes and improve overall efficiency. From automation to enhanced reporting capabilities, accounting ERP software plays a crucial role in modern-day accounting practices.

Key Features of Accounting ERP Software:

- Financial Management: Accounting ERP software allows businesses to manage their financial transactions, track expenses, and generate financial reports in real-time.

- Automation: One of the key features of accounting ERP is automation. It automates repetitive tasks such as data entry, invoicing, and reconciliation, reducing the chances of errors and saving time.

- Integration: Accounting ERP software seamlessly integrates with other business systems such as CRM and inventory management, providing a holistic view of the organization's financial health.

- Customization: Businesses can customize accounting ERP software to meet their specific needs, including creating personalized reports, dashboards, and workflows.

- Compliance: Accounting ERP software helps businesses stay compliant with financial regulations by providing tools for audit trails, tax calculations, and financial controls.

Automation in Accounting ERP:

Automation in accounting ERP software simplifies repetitive tasks and reduces manual errors. By leveraging automation, businesses can streamline processes such as data entry, invoice processing, and reconciliation, leading to increased efficiency and accuracy in financial operations.

Enhanced Financial Reporting:

Accounting ERP enhances financial reporting by providing real-time insights into the organization's financial performance. With robust reporting tools and customizable dashboards, businesses can analyze financial data quickly, identify trends, and make informed decisions to drive growth and profitability.

Implementation of Accounting ERP

Implementing an accounting ERP system is a crucial process for businesses looking to streamline their financial operations. It involves several steps and considerations to ensure a successful integration.

Steps involved in implementing an accounting ERP system:

- Conduct a thorough analysis of current accounting processes and identify areas that need improvement.

- Choose the right ERP software that aligns with the business requirements and goals.

- Develop a detailed implementation plan with clear timelines, responsibilities, and milestones.

- Train employees on how to use the new ERP system effectively.

- Test the system extensively before going live to ensure functionality and data accuracy.

- Monitor the system post-implementation to address any issues and optimize performance.

Challenges businesses may face during ERP implementation:

- Resistance from employees who are accustomed to traditional accounting methods.

- Data migration issues when transferring existing data to the new system.

- Lack of top management support and involvement in the implementation process.

- Integration complexities with other existing software systems within the organization.

- Budget constraints leading to compromises in the quality of the ERP implementation.

Best practices for successful integration of accounting ERP:

- Involve key stakeholders from different departments in the planning and decision-making process.

- Communicate effectively with employees about the benefits of the new ERP system and provide training sessions.

- Set realistic goals and expectations for the ERP implementation to avoid delays and setbacks.

- Regularly review and assess the performance of the ERP system to make necessary adjustments and improvements.

- Work closely with the ERP vendor for ongoing support and updates to ensure the system remains efficient and up-to-date.

Benefits of Accounting ERP

Accounting ERP systems offer a wide range of benefits for businesses, from improving efficiency in financial operations to providing cost-saving solutions and enhancing decision-making processes.

Improved Efficiency in Financial Operations

- Automation of repetitive tasks such as data entry and reconciliation, reducing the risk of errors and saving valuable time.

- Streamlining of processes through integrated modules, allowing for seamless data flow and communication between departments.

- Centralized database for all financial information, ensuring data consistency and accuracy across the organization.

Cost-Saving Benefits of Using Accounting ERP

- Reduction in manual labor costs associated with traditional accounting processes, leading to increased productivity and efficiency.

- Minimization of errors and fraud due to automated controls and real-time monitoring of financial transactions.

- Optimization of resources by eliminating the need for multiple software systems and reducing IT maintenance costs.

Enhanced Decision-Making with Real-Time Data Access

- Instant access to up-to-date financial information, enabling quick and informed decision-making by management and stakeholders.

- Ability to generate customizable reports and dashboards for better insights into the company's financial performance.

- Integration of predictive analytics and forecasting tools for proactive decision-making based on real-time data analysis.

Comparison of Accounting ERP Systems

When looking at different accounting ERP systems available in the market, it's important to consider the unique features and capabilities of each system. This comparison will help businesses make an informed decision based on their specific needs and requirements.

1. QuickBooks

QuickBooks is a widely-used accounting ERP system known for its user-friendly interface and accessibility for small to medium-sized businesses. Some key features of QuickBooks include:

- Easy invoicing and expense tracking

- Customizable reports and dashboards

- Integration with third-party apps

- Cloud-based storage for easy access

2. Sage Intacct

Sage Intacct is a cloud-based accounting ERP system designed for larger enterprises with complex financial needs. Here are some unique features of Sage Intacct:

- Automated billing and revenue recognition

- Advanced financial reporting and analytics

- Integration with CRM and other business systems

- Multi-entity and multi-currency support

3. NetSuite

NetSuite is a comprehensive ERP system that includes accounting functionality along with other business management tools. Key features of NetSuite's accounting module include:

- Real-time financial consolidation

- Inventory and order management

- Project accounting and resource management

- Customizable workflows and approvals

Factors to Consider When Choosing an Accounting ERP Solution

When evaluating different accounting ERP systems, businesses should consider factors such as:

- Scalability to accommodate future growth

- Integration with existing systems and applications

- User-friendliness and ease of implementation

- Cost of ownership, including licensing and support fees

End of Discussion

In conclusion, accounting ERP emerges as a powerful tool that not only streamlines financial processes but also improves operational efficiency and strategic decision-making. By embracing the integration of accounting with ERP systems, businesses can unlock a world of opportunities for growth and success in today's dynamic market landscape.

FAQ Overview

What are the key features of accounting ERP software?

Key features of accounting ERP software include integrated financial modules, real-time reporting, customizable dashboards, and automated data entry.

What challenges might businesses face during ERP implementation?

Challenges during ERP implementation may include data migration issues, resistance from employees, and the need for extensive training.

How does accounting ERP enhance financial reporting?

Accounting ERP enhances financial reporting by providing real-time access to data, enabling accurate forecasting, and improving overall data integrity.